The American Banking Experience as a Foreigner

This is one of the articles that has been sitting in my draft folder for a long time. Every time I had an interaction with a bank I added to it. I feel confident at this point to publish because my experiences with getting a bank account or a credit card here in the US have been mostly awful.

Let me back up a bit. I moved to the US in September 2019. I am not a US citizen, I already had a social security based on a former Business visa. At the time of writing this article I have a green card. I do understand that the situation of not having a credit score and not being a citizen is not a great start, but most banks accommodate for that so I didn’t expect major issues.

In total I tried to be a client of 8 different banks/financial providers: Ally, Capital One, JP Morgan Chase, Bank of America, Monzo USA, the Apple Credit Card, Marcus and Venmo.

I wanna go through them one by one. Note that all of these experiences are very much experiences from a single person. You might be happy with every single one of these banks and might hate the banks that I had no issues with.

Capital One #

I first heard about Capital One when I was living at San Francisco because their downtown cafe was one of the coffee shops for working in as they offer great wifi. They market themselves as being hip and looking forward and make claims in their commercials about being able to open a bank account in 5 minutes online…

I mainly chose them because they have a secured credit card, a credit card you can get even without credit history where you have to put a certain amount of money in escrow which will then be your credit limit (you lend them $500 and you get a credit limit of $500 + a little bit). Seemed like a good deal to me so I filled out their online application. This is where my memory is a little blurry, but I remember it this way. I got a letter in the mail that ask me to provide a government issue photo ID and a copy of my proof of social security number. Additionally they set a deadline to which I had to provide it (~ 30 days).

The only way to provide this information was via fax or mail!!!

This already pissed me off. Especially if you claim to be super hip and modern and in general the future of all banking! I was under the impression that doing this paperless is completely viable solution.

But this is not where the story ended. I signed up for one of these online fax services because I didn’t feel like buying envelopes, going to a print shop and bringing these documents to a post office. So I scanned the documents, faxed it and then waited. For a while …

As the deadline grew closer I gave the hotline a call. Turned out they couldn’t read the documents because of some problems with the transmission (the fax document was cut off). I was never notified about any of this. I was talking through different scenarios. I offered to go to any of their branches to show the documents. Not possible because “different process”. And because they already created a hard inquiry on my credit file (something you should avoid as much as possible, so I have been told), I was stuck with going forward with this. Restarting the process would probably been easier but I would have risked a second inquiry. They were kind enough to extend the deadline and I caved and decided to mail in a copy of the necessary documents.

Repeat the process. I didn’t hear anything. I called multiple times and was assured the documents haven’t arrived yet (to this day I have no confirmation if the documents ever arrived at the bank). Ultimately I was able to get the documents in by faxing them through a different fax service and the documents came out fine.

It was a very annoying process just to get a credit card. The last annoyance was the fact that you decide yourself how much money you put in escrow (Capital One lets you put in up to $1000). I didn’t realize at the time that you only have one chance. Stupidly I only put $500 up, so the credit limit for me was a little bit over $500 for my only credit card.

Anyway in the meantime, my deposit was returned, my credit limit increased and I even was able to get a second credit card with them without a credit inquiry. Still their process is absolutely horrible and inflexible AF…

Apple Credit Card #

This is one of the services where I honestly can’t complain too much. If you have an iPhone this is a rather quick process. Fill out an application on your phone, wait a little and you got a credit card. They offered me one with a limit of $1000 even though I didn’t have any credit history. Their benefits are highly debated online but at that point of my credit journey I would have been happy with any credit card (if you don’t have a credit card you can’t build up your credit score).

The only thing that annoys me slightly is that there is no integration to any online budgeting tools (I use YNAB). You can only download your monthly statements as QXF and CSV.

Bank of America #

For my Bank of America checking account I went to one of their branches and signed up in person. It was rather painless even though talking to the bank clerk seemed like an eternity. I got a checking account and vaguely considered getting a credit card as well. But due to laziness and because I was already set with two credit cards it didn’t seem like worth the effort. I had no reason to complain about Bank of America. Even the fact that I currently can’t change my immigration status online but their app harasses me every time I log in to change my US address to a foreign address seems like a minor issue in comparison to prior experiences.

My mood changed though once I opened a business account with them…

In addition to a business checking account I also wanted a business credit card. But because my business was new and my personal credit score wasn’t great at the time they were only able to offer me a secured credit card. This time I ran into issues that seemed just too familiar to Capital One.

As I was meeting in one of their branches (at the height of a pandemic) I was naive enough to believe that this time it would be different. But essentially in order to get a secured credit card I had to open a CD account first, put the amount of my credit limit in it and the could get the credit card. The CD account was set up in no time. Then I filled out the application for the credit card and again, nothing happened. Multiple calls with the call center and the actual bank clerk I talked to before but the result was always “it’s pending”. I am now in process of closing the business (for unrelated reasons) and don’t care about the credit card anymore.

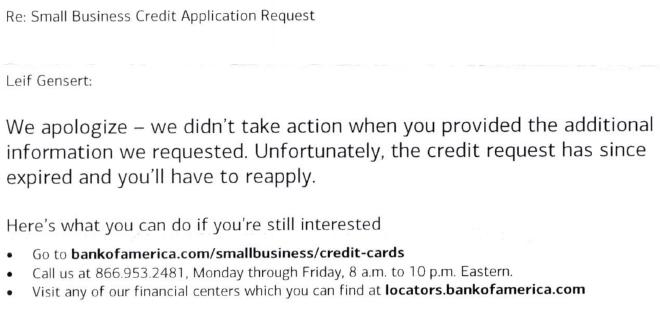

But then just recently Bank of America sent me a letter to my business address:

So essentially they are seeing “Ooops our bad, too bad LOL”. But hey at least I still have the CD account that yielded me almost $10 in interest…

Ally Bank #

Another bank in the category of “We are young and hip so everything is better with us”. They actually do look very appealing and after my wife had a great experience with them signing up I thought why not give it a try.

So I did, went through the process. Submitted my application aaaaaaand was rejected. Took me a little bit of reading of their FAQ to figure out Ally Bank only offers accounts to US citizens and “lawful permanent residents”.

They could have been more upfront about that (it was pretty much then when I realized that lawful permanent resident is just a fancy word for green card holders and at the time I didn’t have my green card yet). They probably have their reasons but honestly other banks make it possible for visa holders to get a bank account, so figure it out. Would send a great message.

Monzo USA #

I was a somewhat happy customer of Monzo in the UK. I liked their app, opening the account was pretty easy. As soon as they announced they were coming to the US I signed up on their waitlist. Last week I got in.

So I went through the signup process which included uploading a state ID and recording a video of yourself and then they went in pending mode.

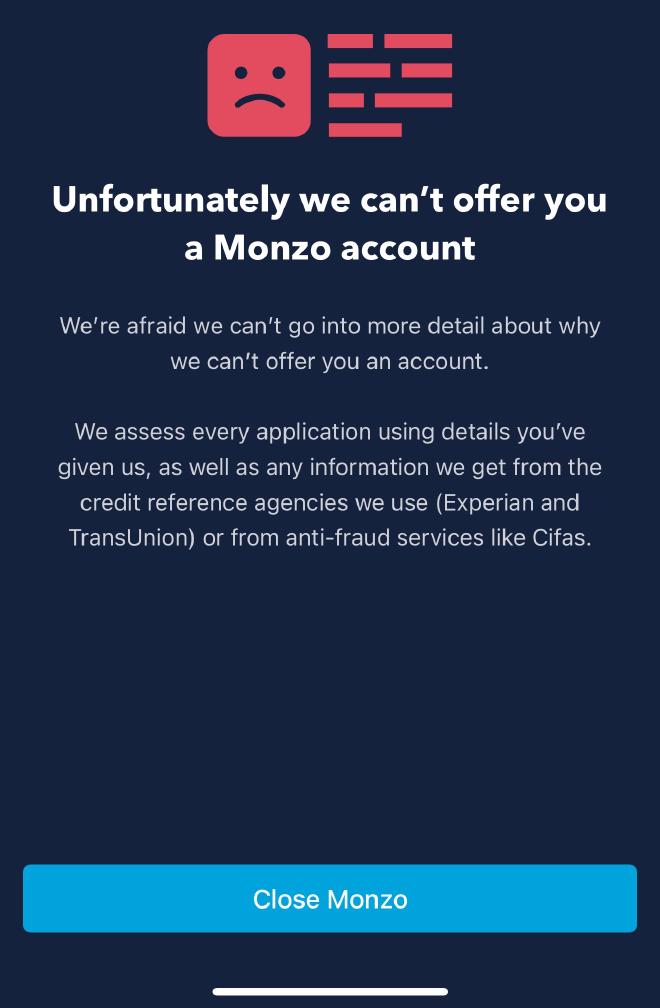

After 24 hours was rejected with this message:

There is no way to repeat the application process with the same email address and I can only speculate about the reason.

I’m wondering if the fact that I am not a citizen has something to do with it but according to their FAQ I should be eligible:

In order to open an account with us, you will need to be a current full-time US resident over the age of 18, and possess a Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN).

Venmo #

Oh yeah Venmo. Tech entrepreneur’s pipe dream of the future of banking through radical capitalism combined with social media. Even though I hate the fact that a company like this is possible (wiring money from one account to another account for free shouldn’t be rocket science), Venmo is super useful when you want to send a couple of bucks over to your friend.

I already had a Venmo account from 2015 so I just assumed I could reactivate it. But because a lot of things nowadays are tied to a phone number (cough club house) I wasn’t able to log in as my phone number from 2015 was disconnected. Usually an issue like this can be resolved by talking to customer support.

Unfortunately for in order to let me log in they wanted me to provide all kinds of documents I wasn’t able to give them (didn’t have US driver’s license and my visa just expired). So pretty frustrating not being able to log into an existing account (no idea what would have happened if I still had that phone number, but needing to confirm your identity should probably be independent of access to a phone number).

Marcus #

Marcus is a dedicated savings account by Goldman Sachs which currently has great interest rates (yes 0.5% for a savings account is currently considered great). I have no complaints here other than their app and website occasionally say “sorry we’re currently not available”. You won’t be able to even see your balance. Maybe they just want to simulate the frustrating experience of a bank branch online.

Chase #

Some of you might think oh he saves the best story for last. But honestly Chase was the bank that gave me the least amount of headaches. I signed up in person at a time where I was still on a tourist visa, everyone was friendly and even signing up for a credit card was rather painless.

Conclusion #

I am fortunate enough that I am now a green card holder so some of these problem might not have happened with my current status. But it pretty much seems to me the amount of trouble I ran into for different banks are a symptom of deeper issues.

My theory is:

- Processes in American Banking institutions are horribly outdated even for the newer ones

- It is much easier for financial providers to only serve citizens and green card holders

At least the later issue could be address with regulation. Not having a bank account excludes you from a lot of activities in this country. And even if you have a foreign debit or credit card, you will pay a premium for everything.

Attribution: Gray Highrise Buildings by Esso